분산이 일정하지 않은 경우

A Time Series: 12 × 12

1949

112

118

132

129

121

135

148

148

136

119

104

118

1950

115

126

141

135

125

149

170

170

158

133

114

140

1951

145

150

178

163

172

178

199

199

184

162

146

166

1952

171

180

193

181

183

218

230

242

209

191

172

194

1953

196

196

236

235

229

243

264

272

237

211

180

201

1954

204

188

235

227

234

264

302

293

259

229

203

229

1955

242

233

267

269

270

315

364

347

312

274

237

278

1956

284

277

317

313

318

374

413

405

355

306

271

306

1957

315

301

356

348

355

422

465

467

404

347

305

336

1958

340

318

362

348

363

435

491

505

404

359

310

337

1959

360

342

406

396

420

472

548

559

463

407

362

405

1960

417

391

419

461

472

535

622

606

508

461

390

432

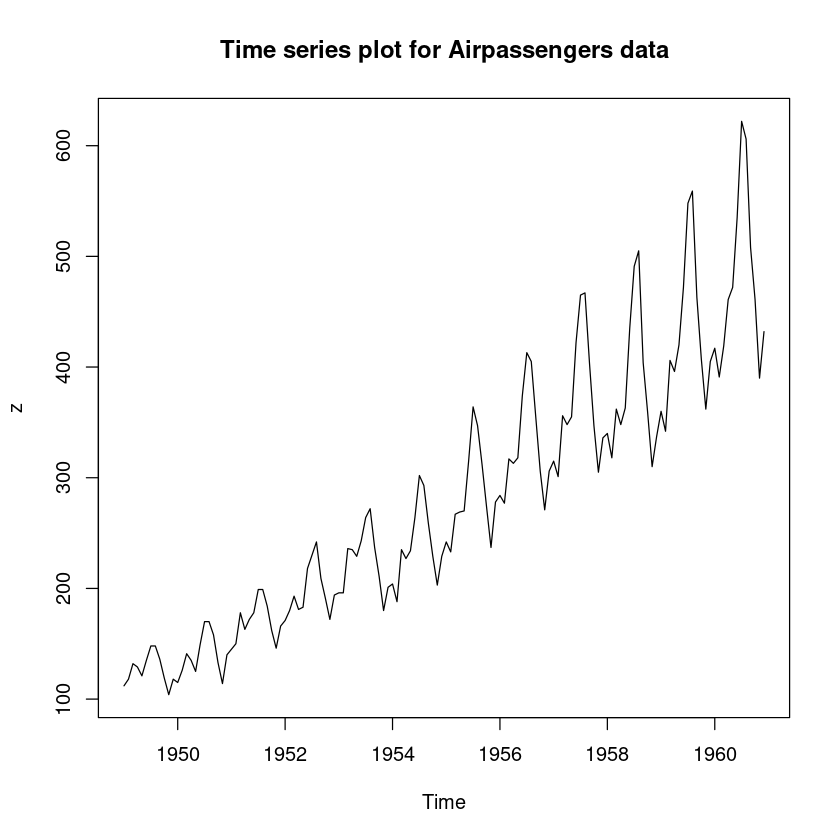

plot.ts (z, main = "Time series plot for Airpassengers data" )

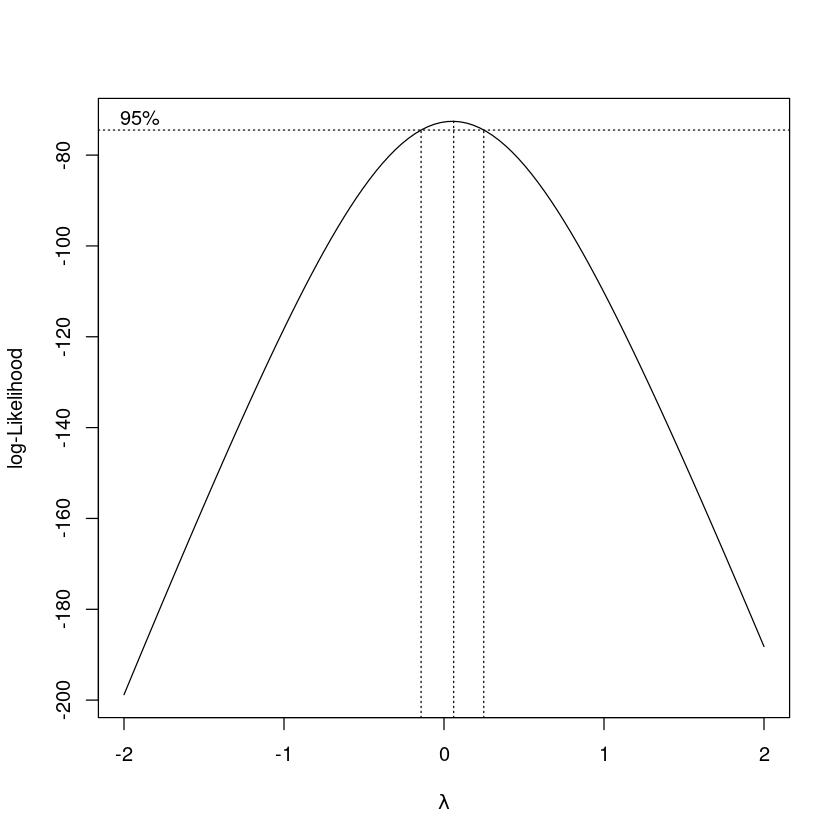

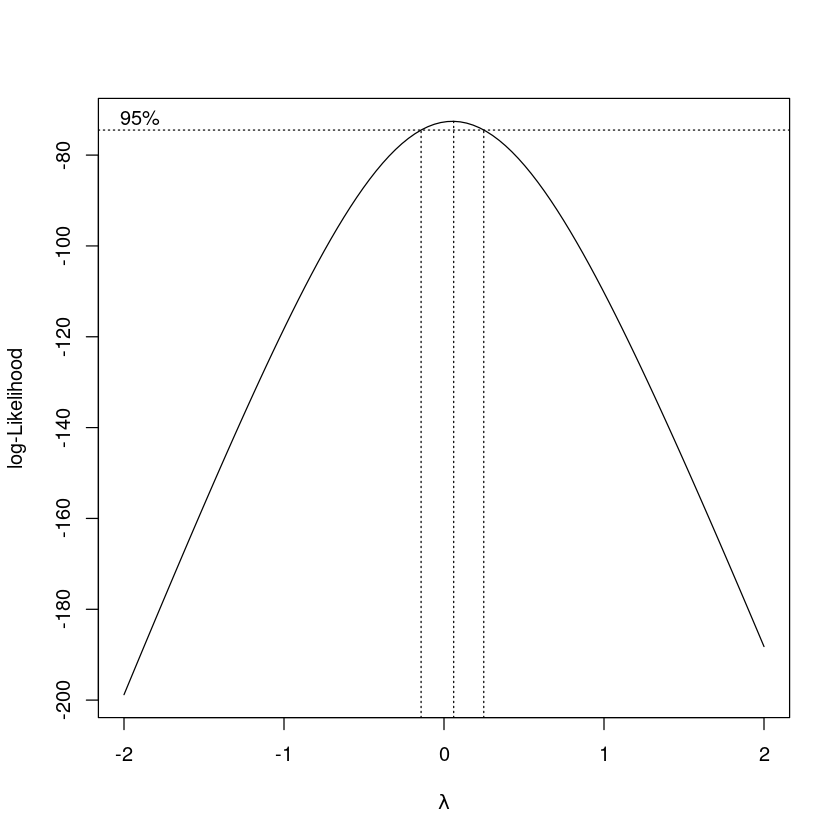

- Box-Cox transformation

\[f_\lambda(Z_t) = \begin{cases}

\dfrac{Z_t^\lambda-1}{\lambda}, & Z_t \geq 0, \lambda>0 \\

log(Z_t), & \lambda=0

\end{cases}\]

:: BoxCox.lambda (z, method= 'loglik' )

Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

0.2

:: BoxCox.lambda (z, method = "guerrero" )

-0.294715585559316

- ts객체가 들어가야함

:: BoxCox (z,lambda= forecast:: BoxCox.lambda (z, method= 'loglik' ))

A Time Series: 12 × 12

1949

7.847352

7.982144

8.276536

8.215632

8.047493

8.336343

8.583833

8.583833

8.356042

8.004073

7.658338

7.982144

1950

7.915451

8.153584

8.452835

8.336343

8.132639

8.602141

8.965606

8.965606

8.762630

8.296592

7.892911

8.433699

1951

8.528312

8.620350

9.094641

8.848653

8.998313

9.094641

9.412543

9.412543

9.188405

8.831619

8.546920

8.899258

1952

8.981998

9.126173

9.324566

9.141833

9.172949

9.677811

9.835957

9.987634

9.554566

9.294754

8.998313

9.339379

1953

9.368824

9.368824

9.912567

9.899908

9.823034

10.000000

10.250736

10.342064

9.925183

9.582316

9.126173

9.441397

1954

9.484251

9.249564

9.899908

9.797051

9.887205

10.250736

10.666479

10.571969

10.192525

9.823034

9.470023

9.823034

1955

9.987634

9.874459

10.285240

10.308071

10.319435

10.799092

11.262611

11.107788

10.768883

10.364560

9.925183

10.409160

1956

10.475107

10.398058

10.819103

10.778978

10.829071

11.351000

11.678616

11.613495

11.181384

10.707761

10.330766

10.707761

1957

10.799092

10.656090

11.190490

11.117061

11.181384

11.750682

12.078927

12.093594

11.605283

11.107788

10.697481

11.004343

1958

11.042269

10.829071

11.244701

11.117061

11.253666

11.852637

12.265784

12.363141

11.605283

11.217686

10.748614

11.013858

1959

11.226711

11.061098

11.621691

11.538992

11.734774

12.130041

12.649244

12.719537

12.064211

11.629871

11.244701

11.613495

1960

11.710799

11.497014

11.726798

12.049443

12.130041

12.564701

13.102063

13.007960

12.383721

12.049443

11.488567

11.829327

:: BoxCox (z,lambda= 'auto' )

A Time Series: 12 × 12

1949

2.548535

2.561426

2.588461

2.582990

2.567558

2.593773

2.615143

2.615143

2.595510

2.563492

2.529884

2.561426

1950

2.555089

2.577352

2.603953

2.593773

2.575434

2.616686

2.646282

2.646282

2.629992

2.590249

2.552929

2.602296

1951

2.610433

2.618215

2.656336

2.636968

2.648852

2.656336

2.680161

2.680161

2.663501

2.635595

2.612017

2.641022

1952

2.647572

2.658759

2.673698

2.659957

2.662328

2.699069

2.709945

2.720109

2.690390

2.671486

2.648852

2.674793

1953

2.676962

2.676962

2.715111

2.714262

2.709067

2.720927

2.737151

2.742897

2.715955

2.692360

2.658759

2.682259

1954

2.685357

2.668111

2.714262

2.707296

2.713408

2.737151

2.762643

2.756996

2.733443

2.709067

2.684331

2.709067

1955

2.720109

2.712549

2.739332

2.740768

2.741481

2.770427

2.796406

2.787934

2.768668

2.744300

2.715955

2.747066

1956

2.751119

2.746379

2.771588

2.769257

2.772164

2.801154

2.818211

2.814887

2.791987

2.765084

2.742191

2.765084

1957

2.770427

2.762027

2.792485

2.788447

2.791987

2.821853

2.837961

2.838662

2.814466

2.787934

2.764478

2.782161

1958

2.784288

2.772164

2.795437

2.788447

2.795922

2.826939

2.846793

2.851301

2.814466

2.793969

2.767483

2.782696

1959

2.794460

2.785340

2.815307

2.811044

2.821052

2.840400

2.864196

2.867286

2.837255

2.815726

2.795437

2.814887

1960

2.819842

2.808860

2.820650

2.836545

2.840400

2.860440

2.883580

2.879651

2.852247

2.836545

2.808419

2.825783

- linear model이 들어가야함

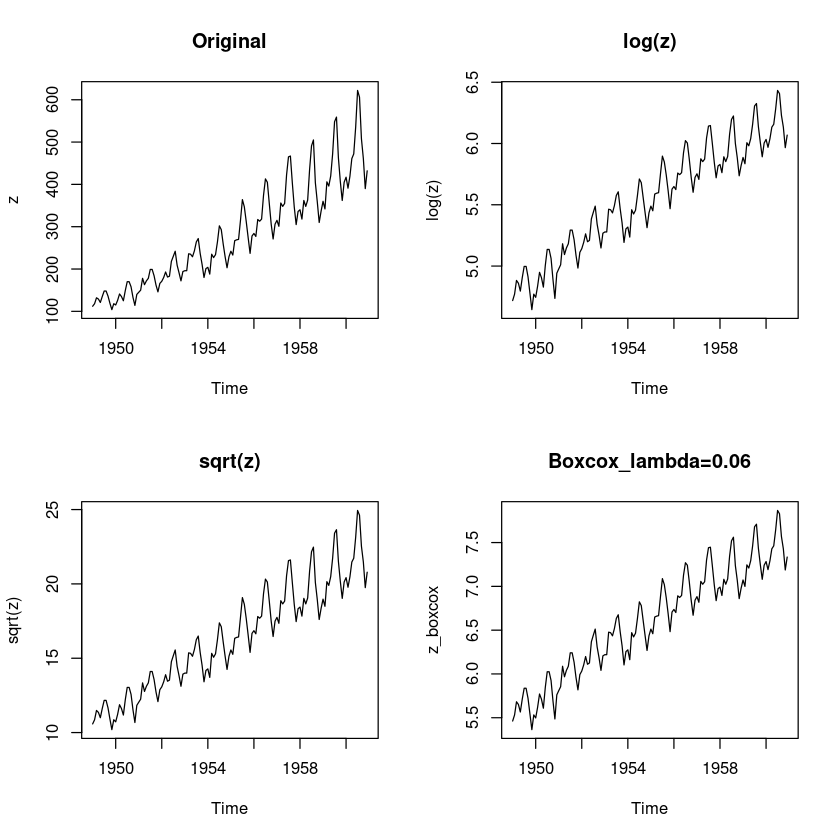

<- forecast:: BoxCox (z, lambda= bc$ x[which.max (bc$ y)])

par (mfrow= c (2 ,2 ))plot.ts (z, main = "Original" )plot.ts (log (z), main = "log(z)" )plot.ts (sqrt (z),, main = "sqrt(z)" )plot.ts (z_boxcox, main = "Boxcox_lambda=0.06" )graphics.off ()

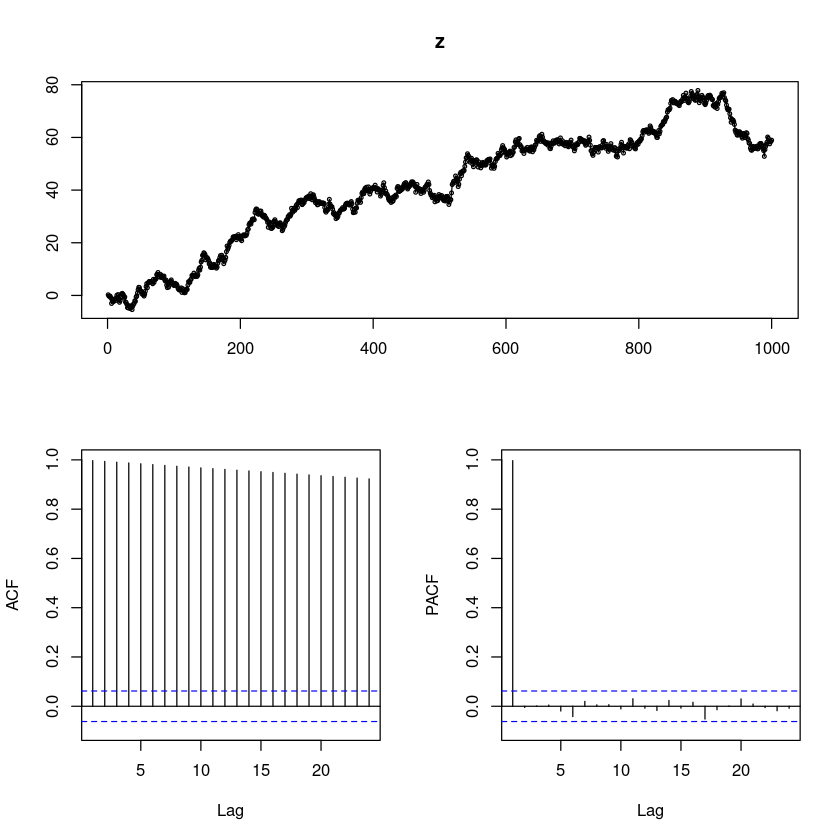

확률적 추세 제거

- 확률보행과정의 정상화

\(Z_t = Z_{t−1} + ϵ_t, ϵ_t ∼ WN(0, σ^2)\) - AR(1) with \(ϕ = 1\)

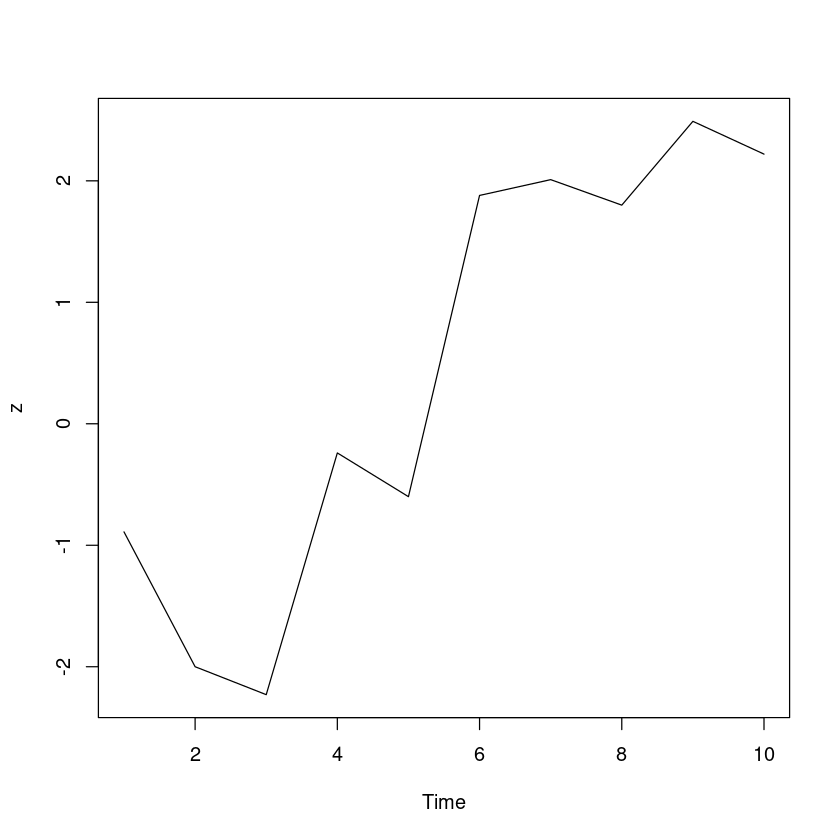

<- round (rnorm (10 ),2 )<- cumsum (e)plot.ts (z)

<- round (rnorm (1000 ),2 )<- cumsum (e):: tsdisplay (z, lag.max= 24 )

\(ΔZ_t = Z_t − Z_{t−1} = ϵ_t\)

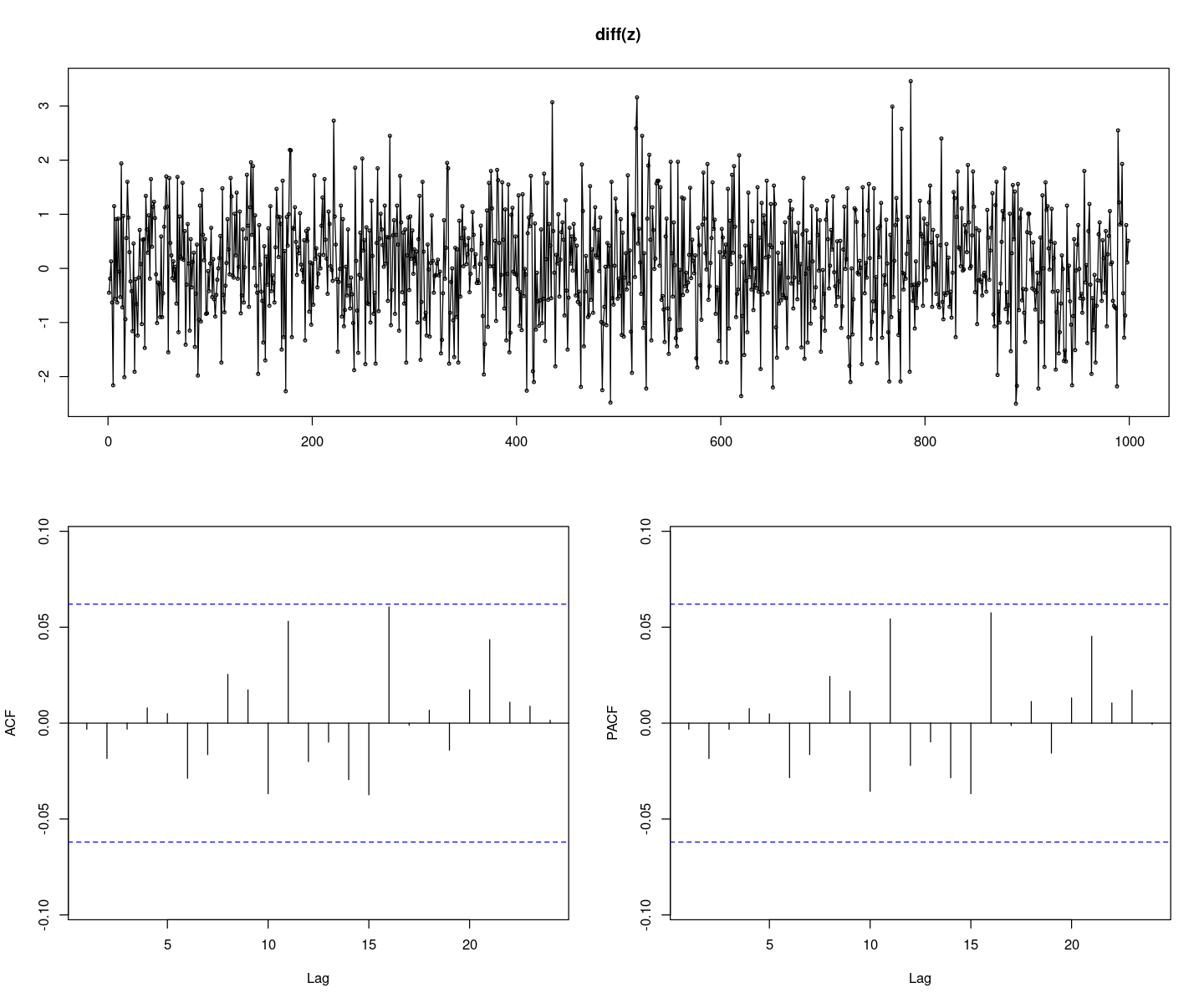

차분한 확률보행과정의 시도표 및 ACF/PACF 그림

- diff:차분함수

예시

4: 7-3 : a[2]-a[1]

-5: 2-7 : a[3] - a[2]

7: 9-2 : a[4] - a[3]

-1: 2-3 : a[3] - a[1]

2: 9-7: a[4] - a[2]

options (repr.plot.width = 12 , repr.plot.height = 10 ):: tsdisplay (diff (z), lag.max= 24 )

\(ΔZ_t ∼ WN = ARMA(0, 0) ⇒ Z_t ∼ ARIMA(0, 1, 0)\)

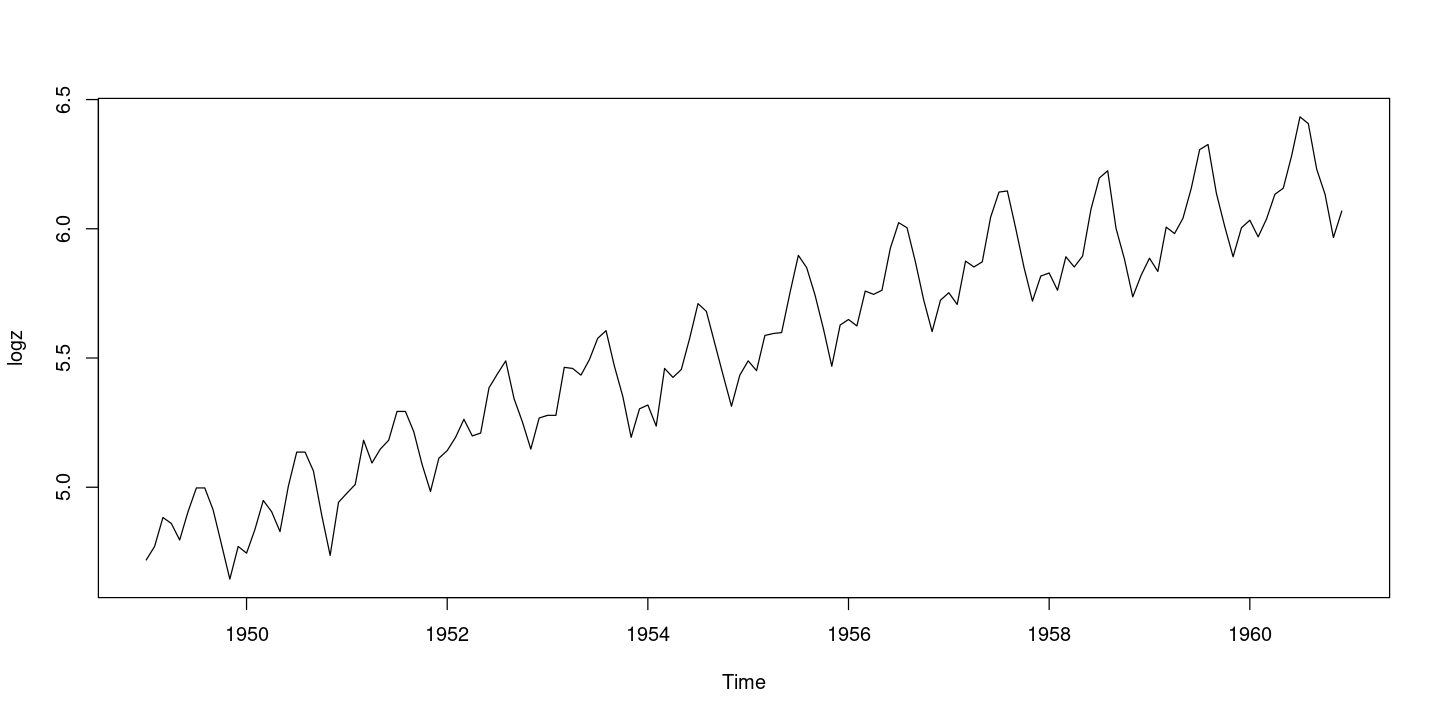

로그변환한 Airpassengers data 에 대한 확률적 추세 확인

<- log (AirPassengers)options (repr.plot.width = 12 , repr.plot.height = 6 )plot.ts (logz)

추세가 있다. 결정적 추세로 해도 될거 같기도 하고…

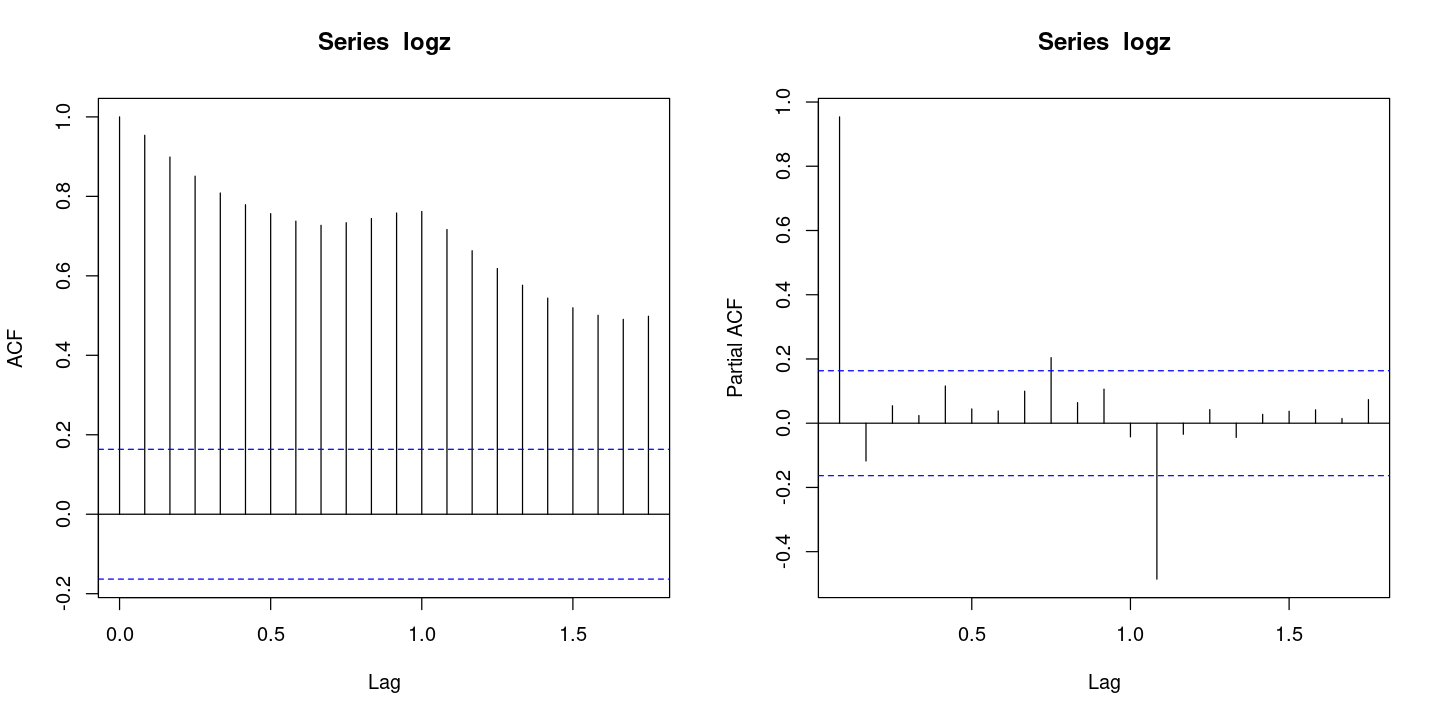

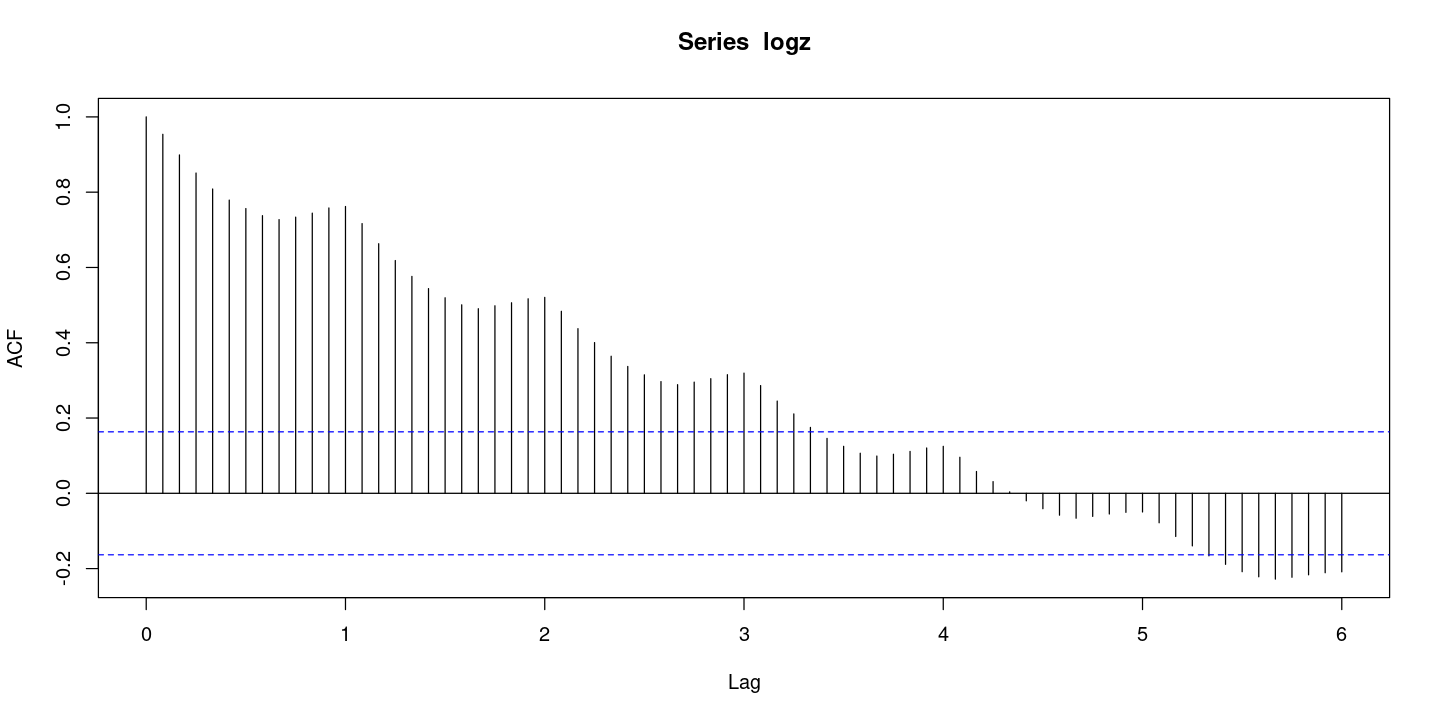

par (mfrow= c (1 ,2 ))acf (logz)pacf (logz)

계절성분 떄문에 acf그래프가 중간에 내려오다가 볼록 튀어 나온 것

차분을 진행한다.

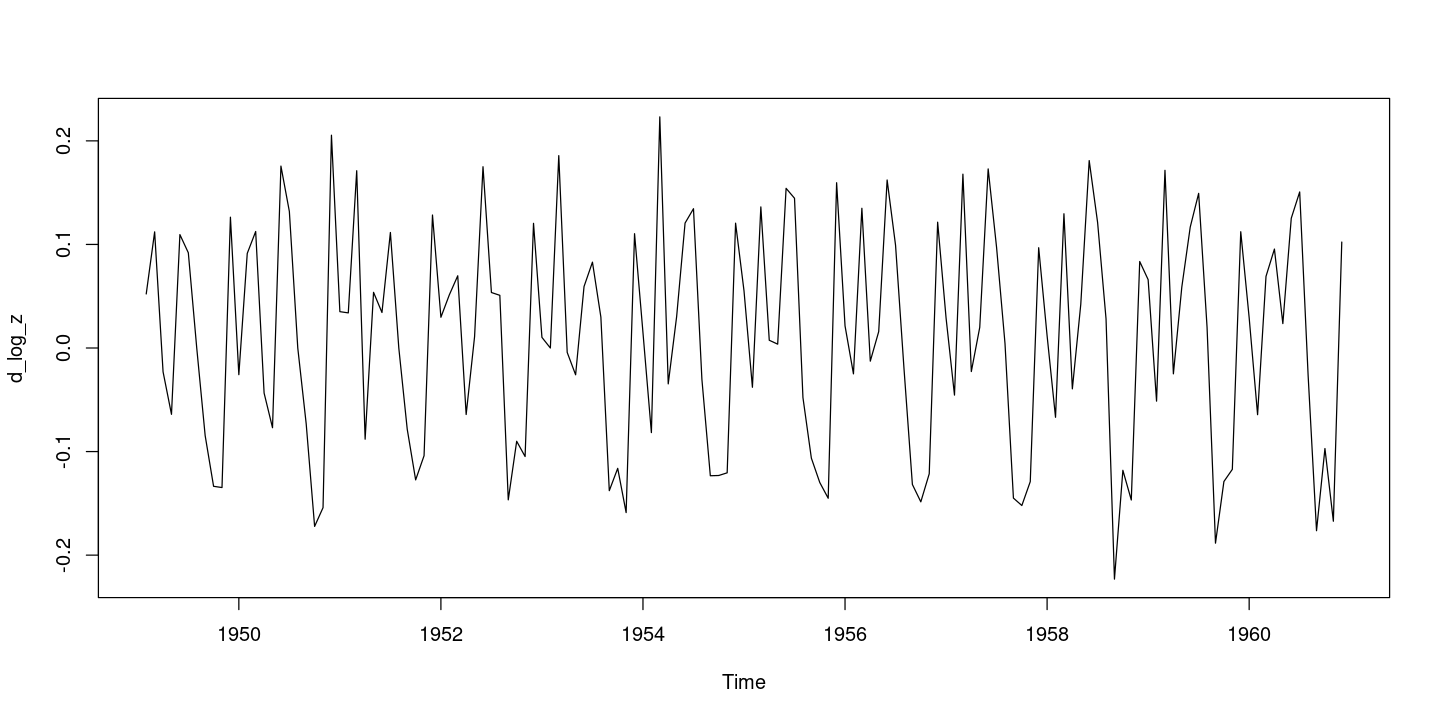

\(ΔZ_t = (1 − B)Z_t = Z_t − Z_{t−1}\)

= diff (logz)plot.ts (d_log_z)

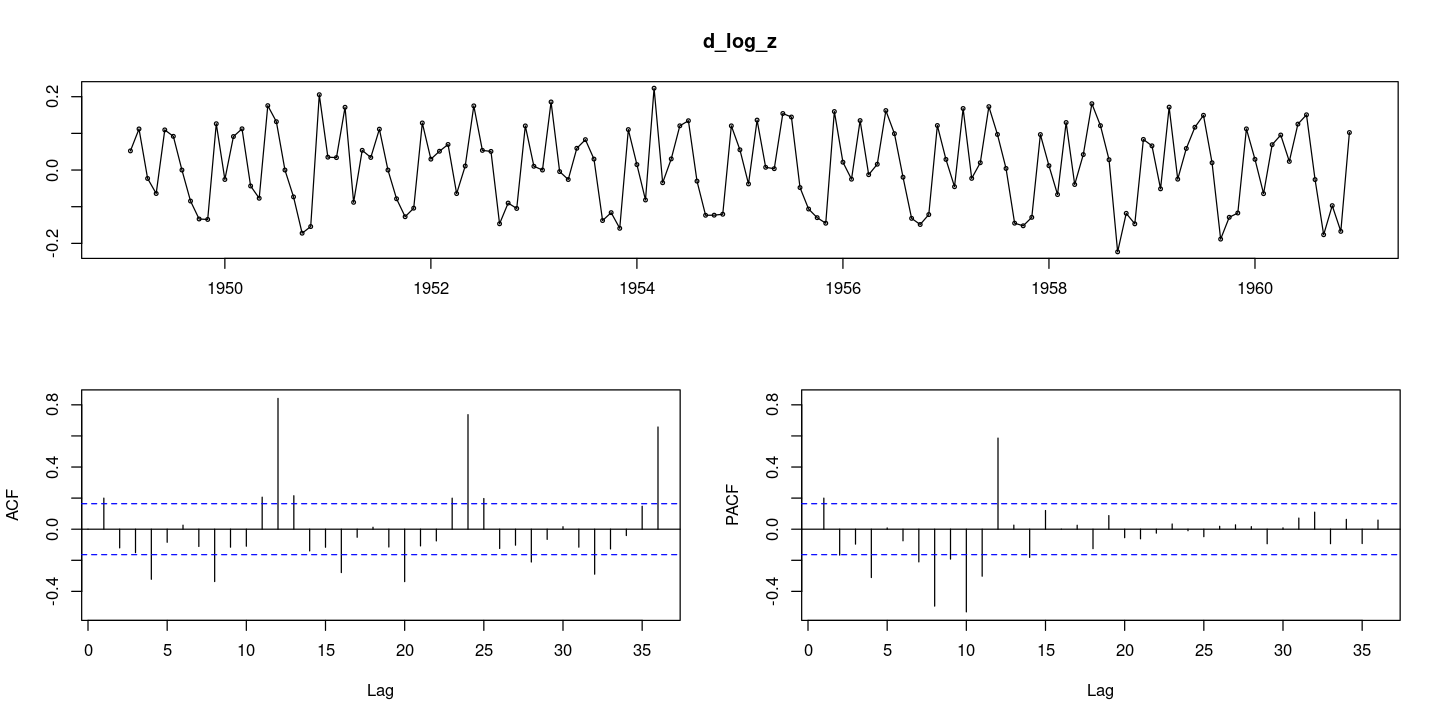

:: tsdisplay (d_log_z, lag.max= 36 )

여전히 계절성분이 남아있으므로, 계절차분 진행

\(Δ_{12}ΔZ_t = (1 − B^{12})(1 − B)Z_t = (1 − B^{12})(Z_t − Z_{t−1}) = Z_t − Z_{t−1} − Z_{t−12} − Z_{t−1}\)

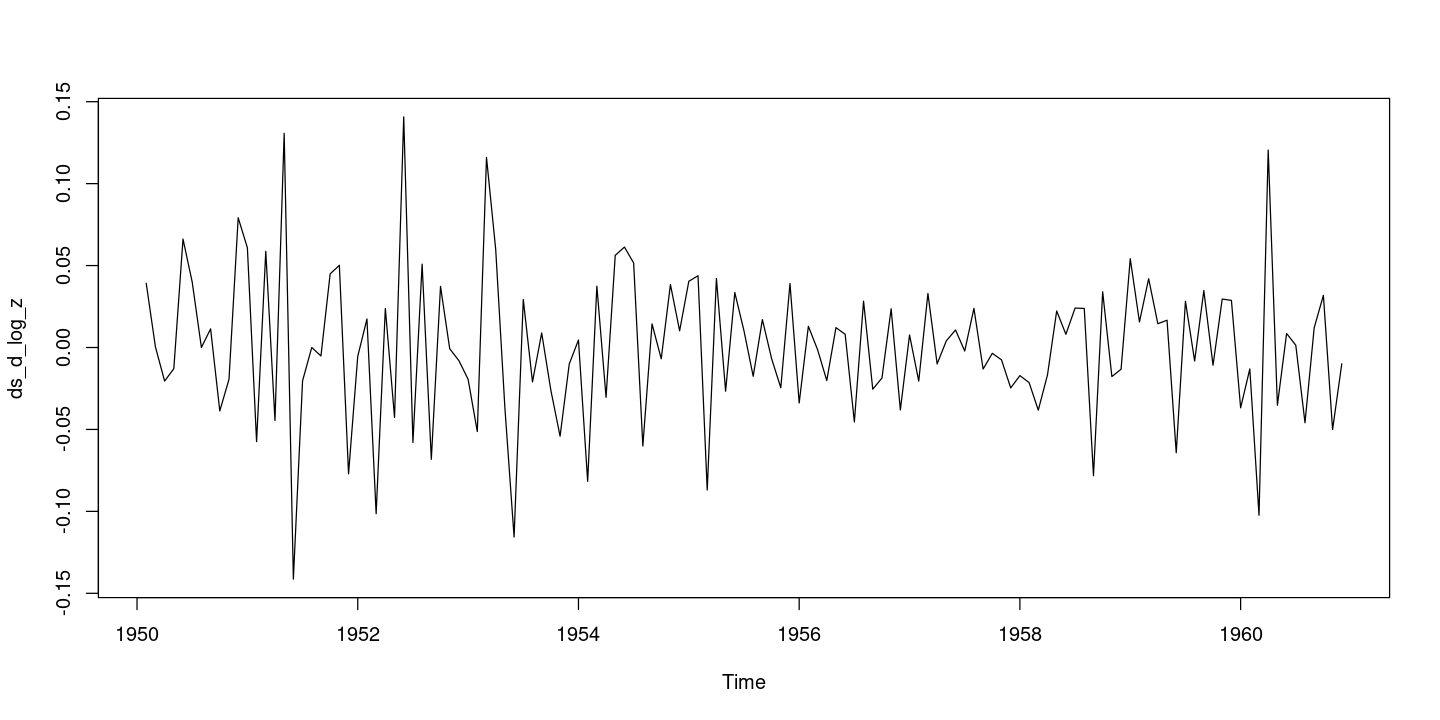

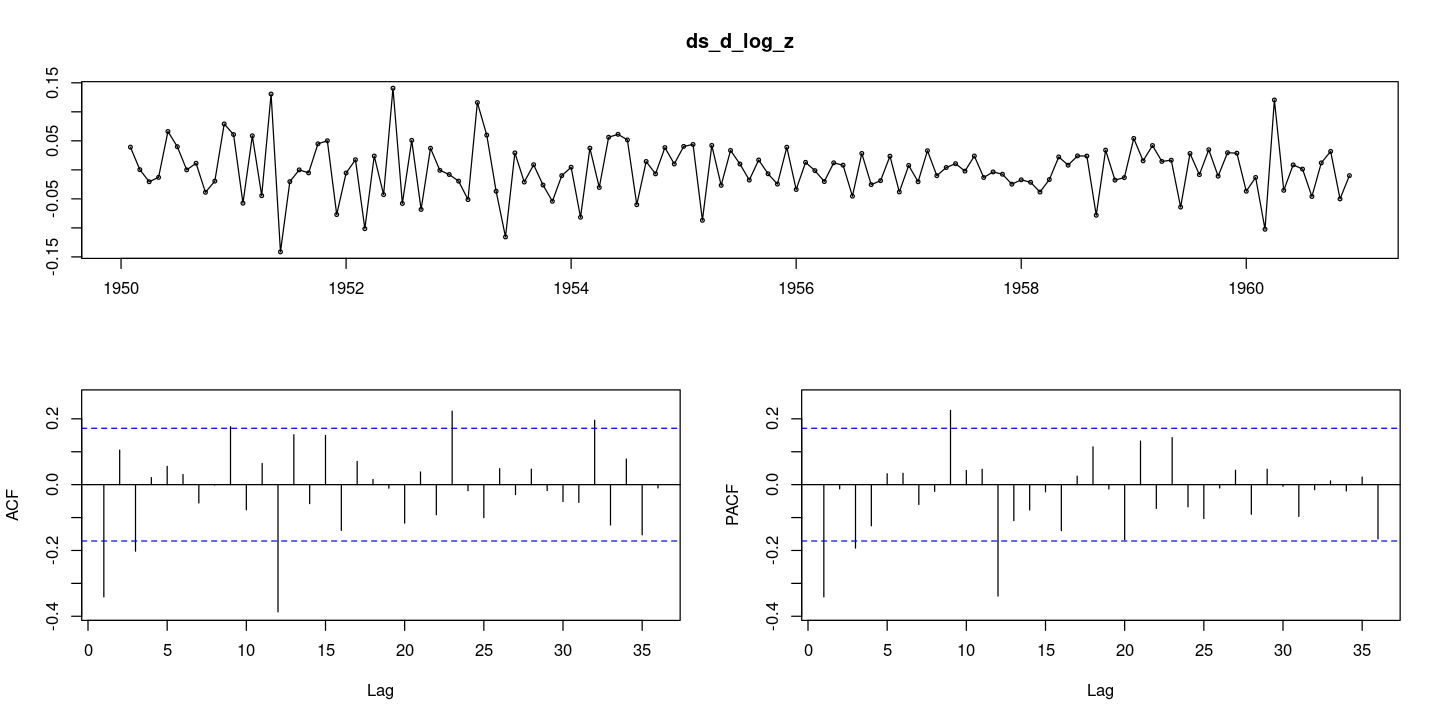

<- diff (d_log_z, 12 )plot.ts (ds_d_log_z)

:: tsdisplay (ds_d_log_z, lag.max= 36 )

하지만, 일반적으로 계절성분과 추세가 동시에 있는 경우 계절차분을 먼저 진행한다

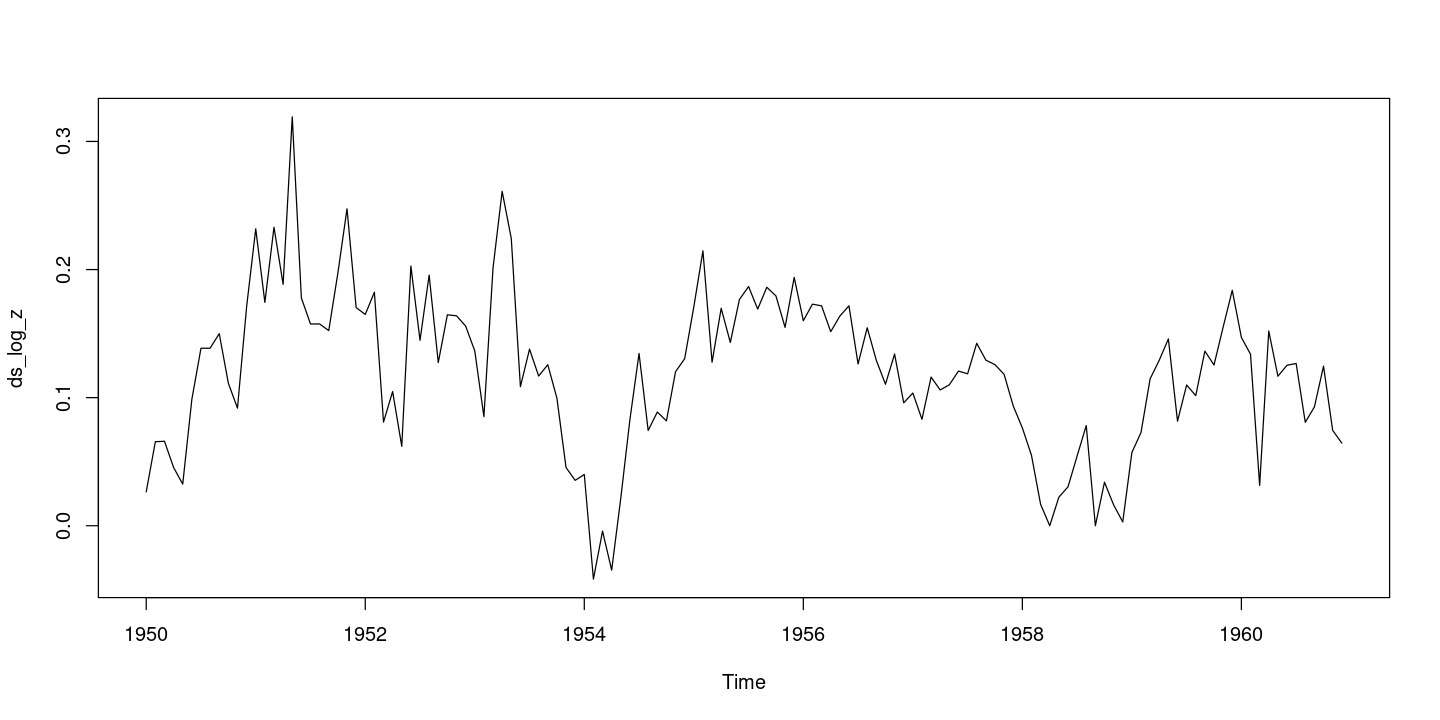

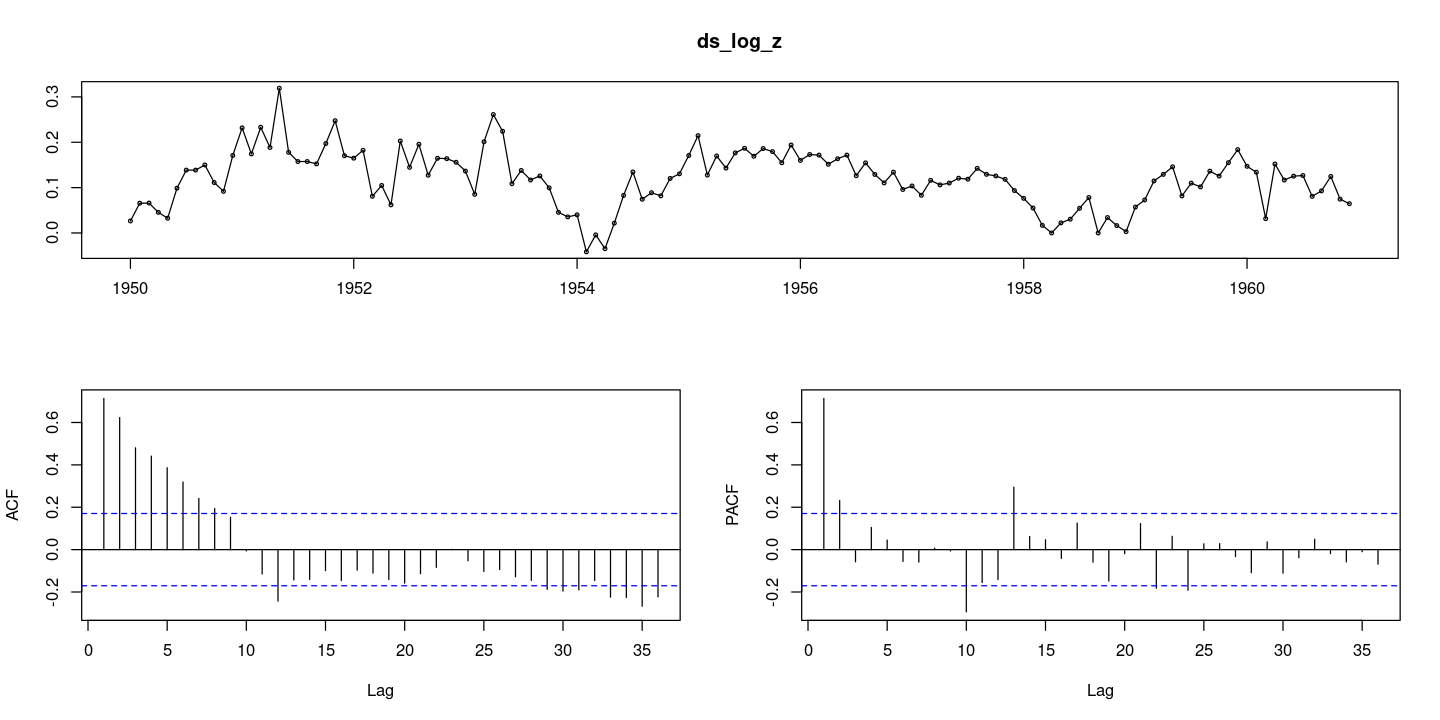

<- diff (logz, 12 )ts.plot (ds_log_z)

:: tsdisplay (ds_log_z, lag.max= 36 )

확률적추세가 있어 보이지만, AR 모형에서 ACF가 감소하는 형태라고 할 수도 있다. 이 경우에는 추세를 제거하기 위한 차분을 더 진행하는 것을 결정하는 것이 어렵다.

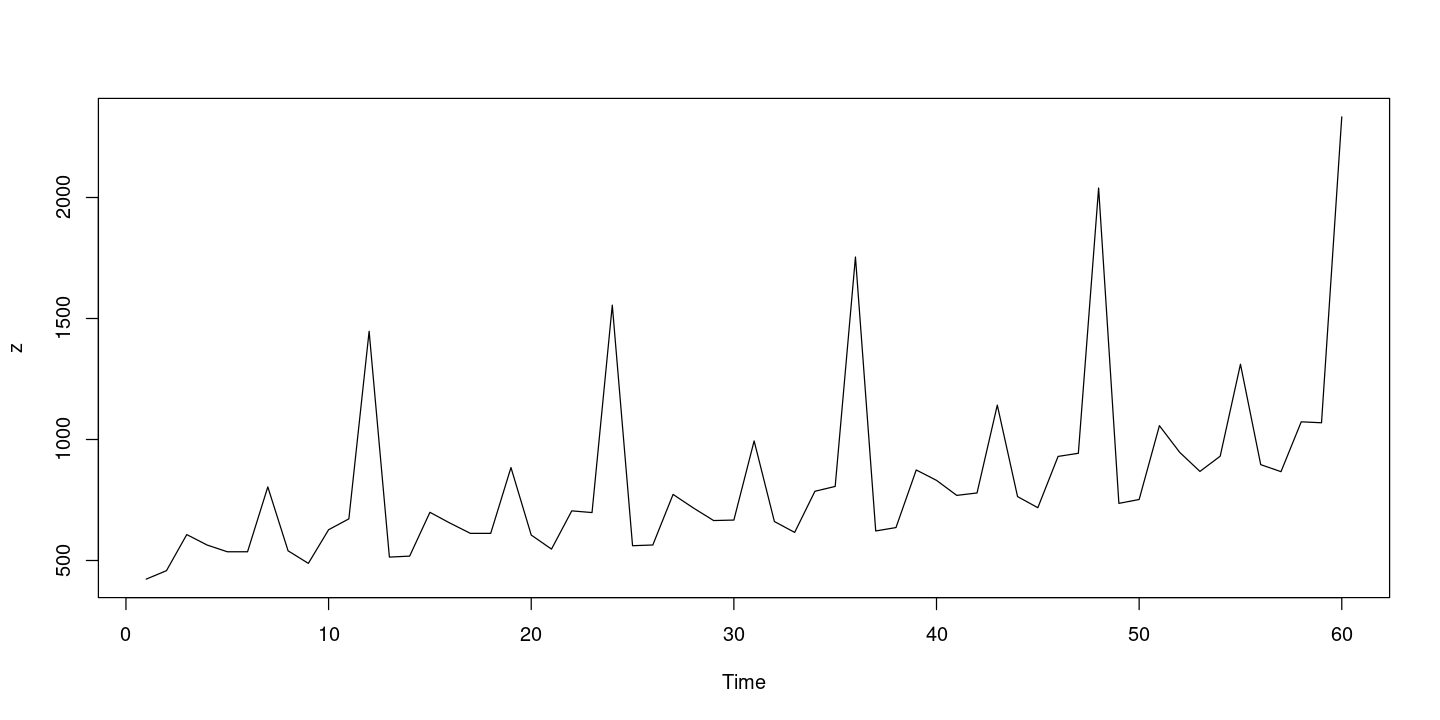

depart data

<- scan ("depart.txt" )plot.ts (z)

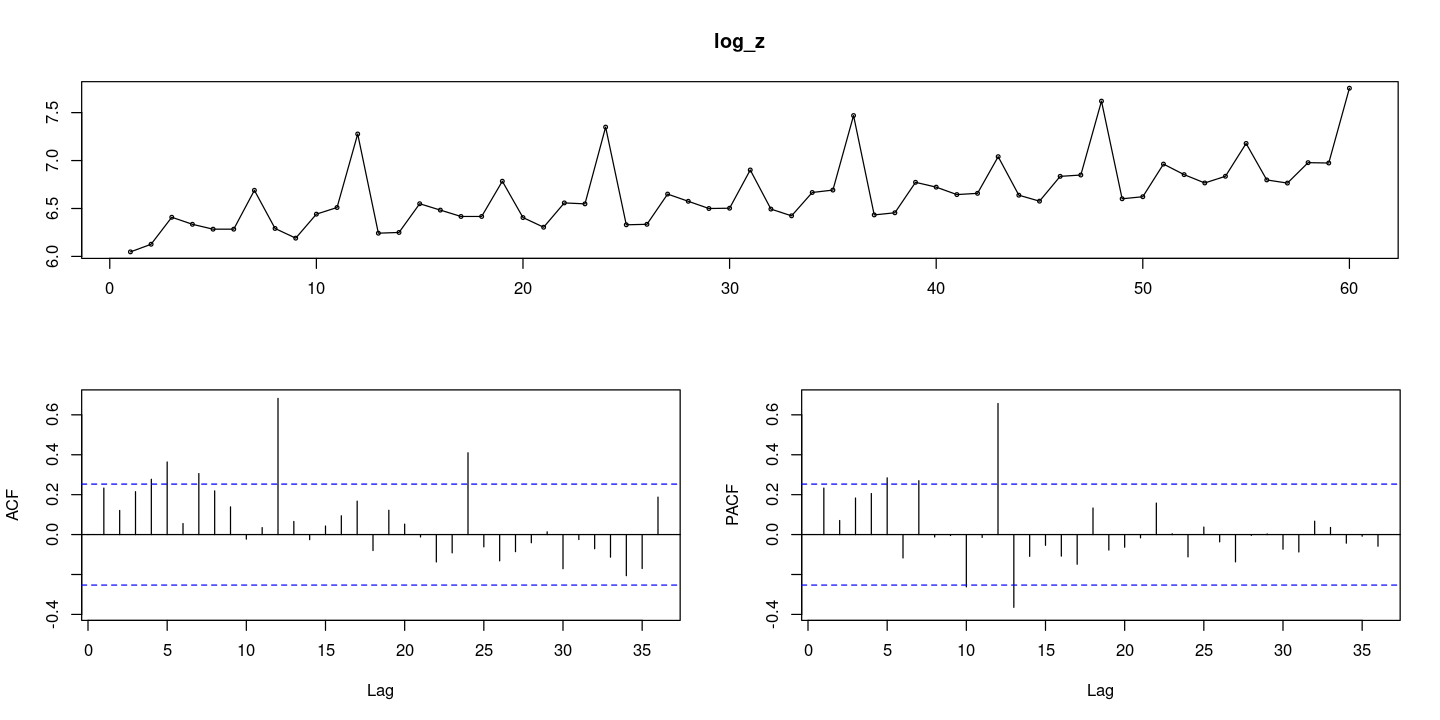

<- log (z):: tsdisplay (log_z, lag.max= 36 )

계절차분을 먼저 진행

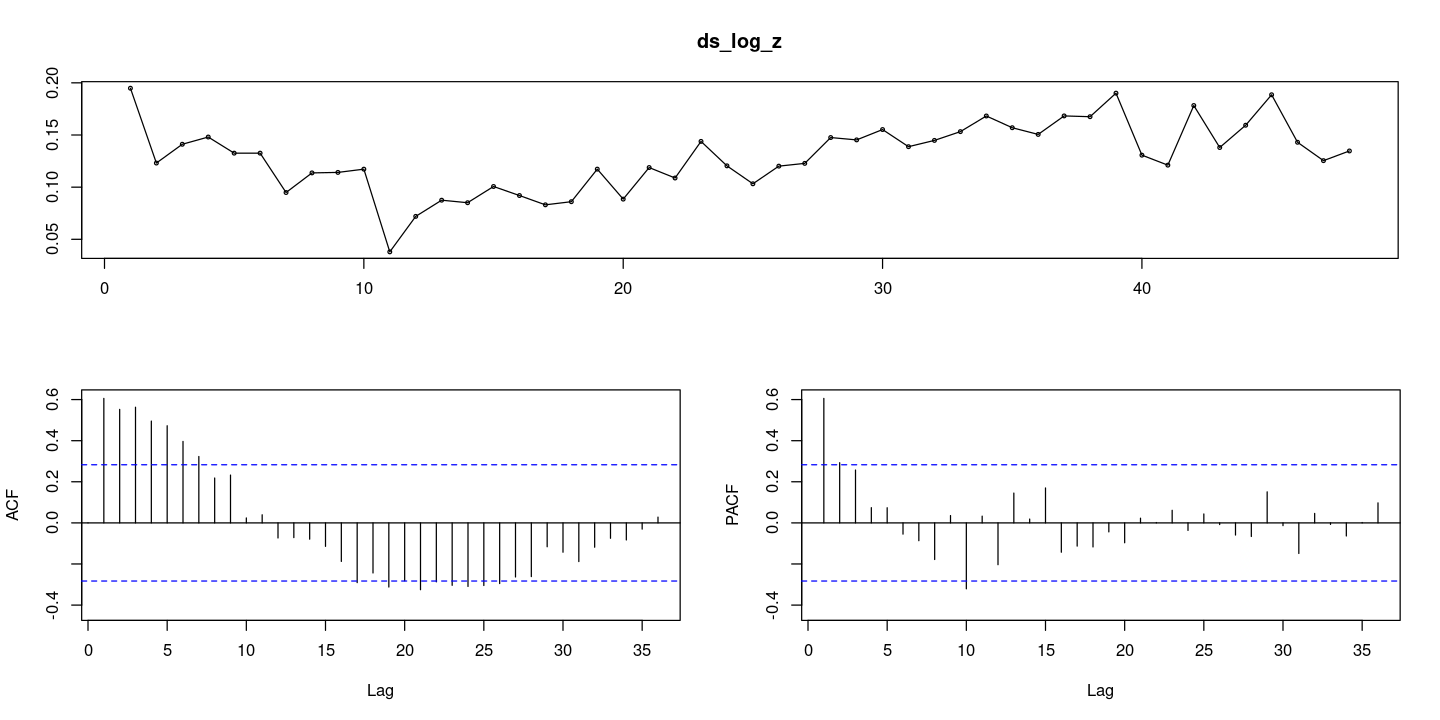

<- diff (log_z, 12 ):: tsdisplay (ds_log_z, lag.max= 36 )

이 데이터 시도표 상으로는 확률적인 추세가 있어보이지만, 역시 ACF만 보고 차분이 필 요한 가에 대한 결정을 하는 것이 쉽지 않다.

여러가지 Simulation

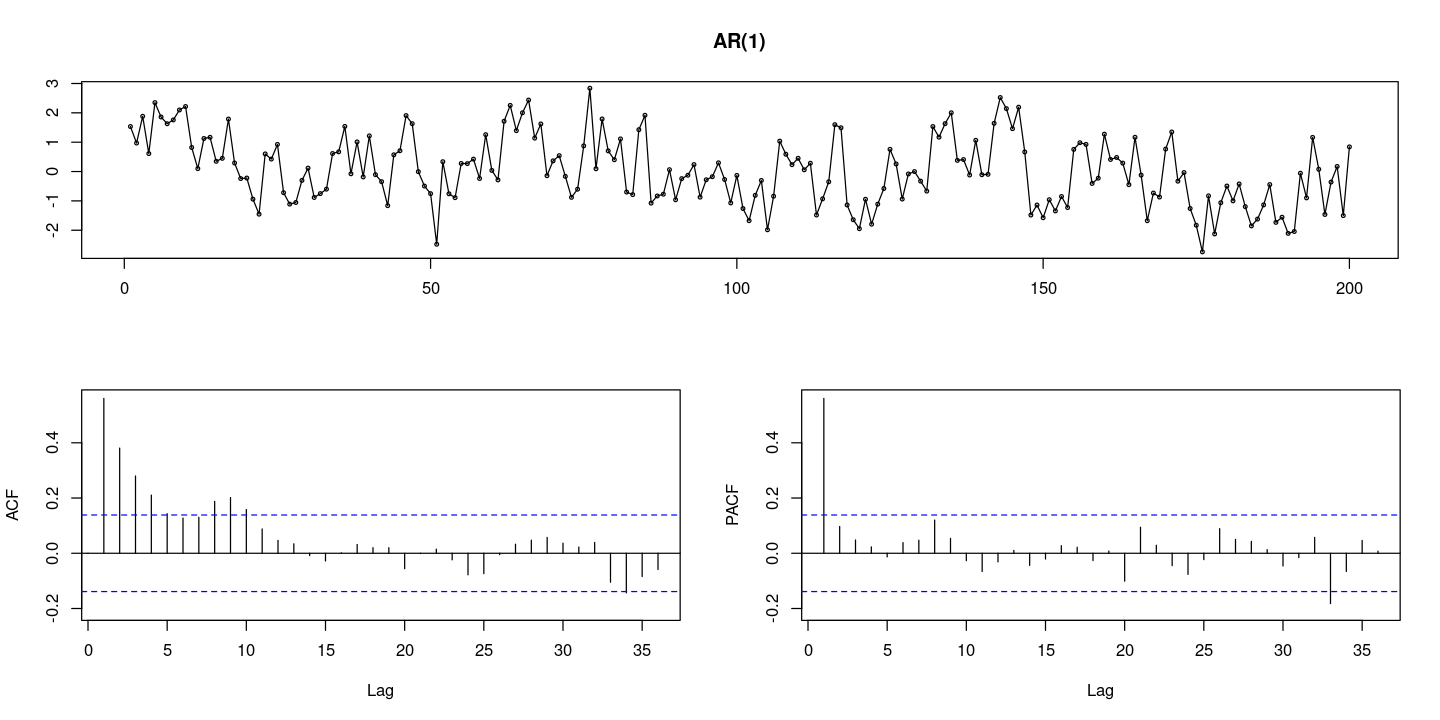

<- 200 = arima.sim (n= n, list (order= c (1 ,0 ,0 ), ar= 0.5 )) #AR(1) = arima.sim (n= n, list (order= c (1 ,1 ,0 ), ar= 0.5 )) #ARIMA(1,1,0)

:: tsdisplay (x, lag.max= 36 , main = "AR(1)" )

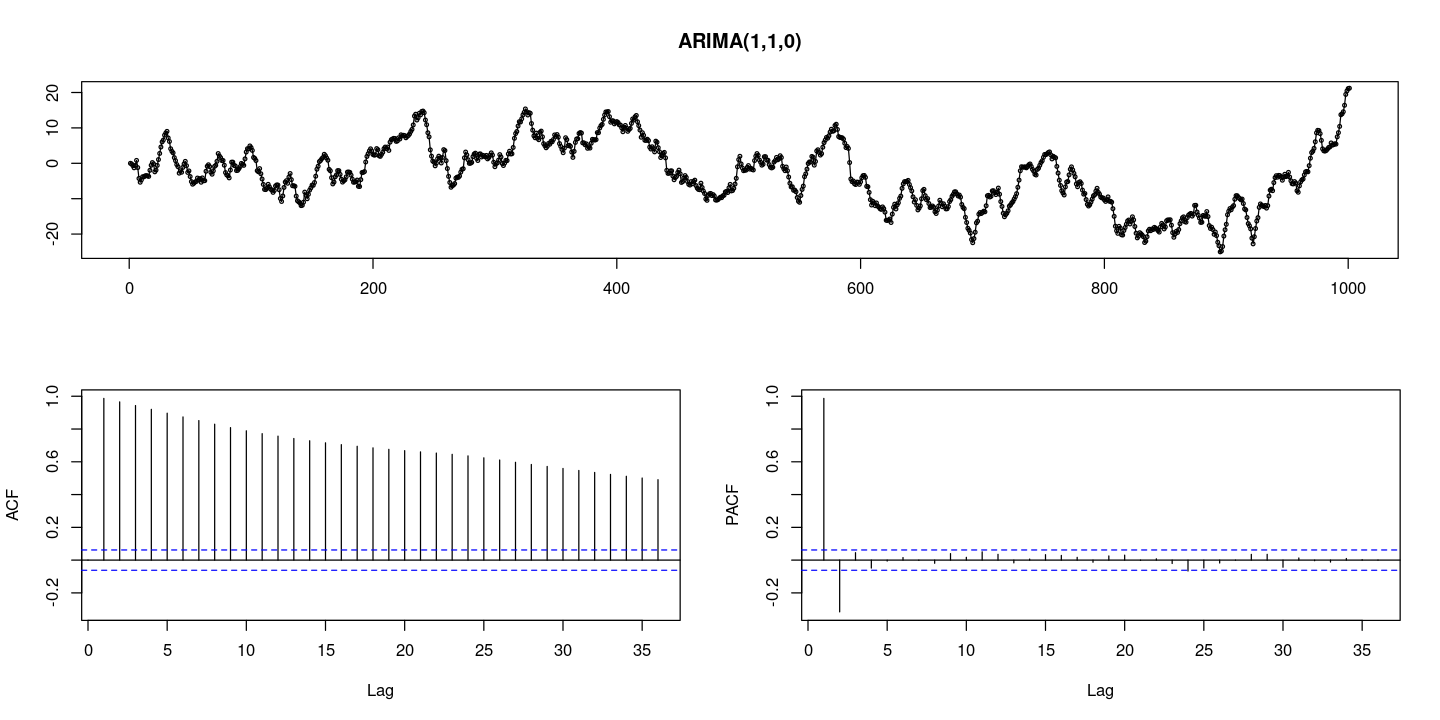

:: tsdisplay (z, lag.max= 36 , main = "ARIMA(1,1,0)" )

acf가 지수적으로 감소하고 있다. 차분이 필요하다.

ARIMA(1,1,0)모형은 차분하면 AR(1)모형이 된다.

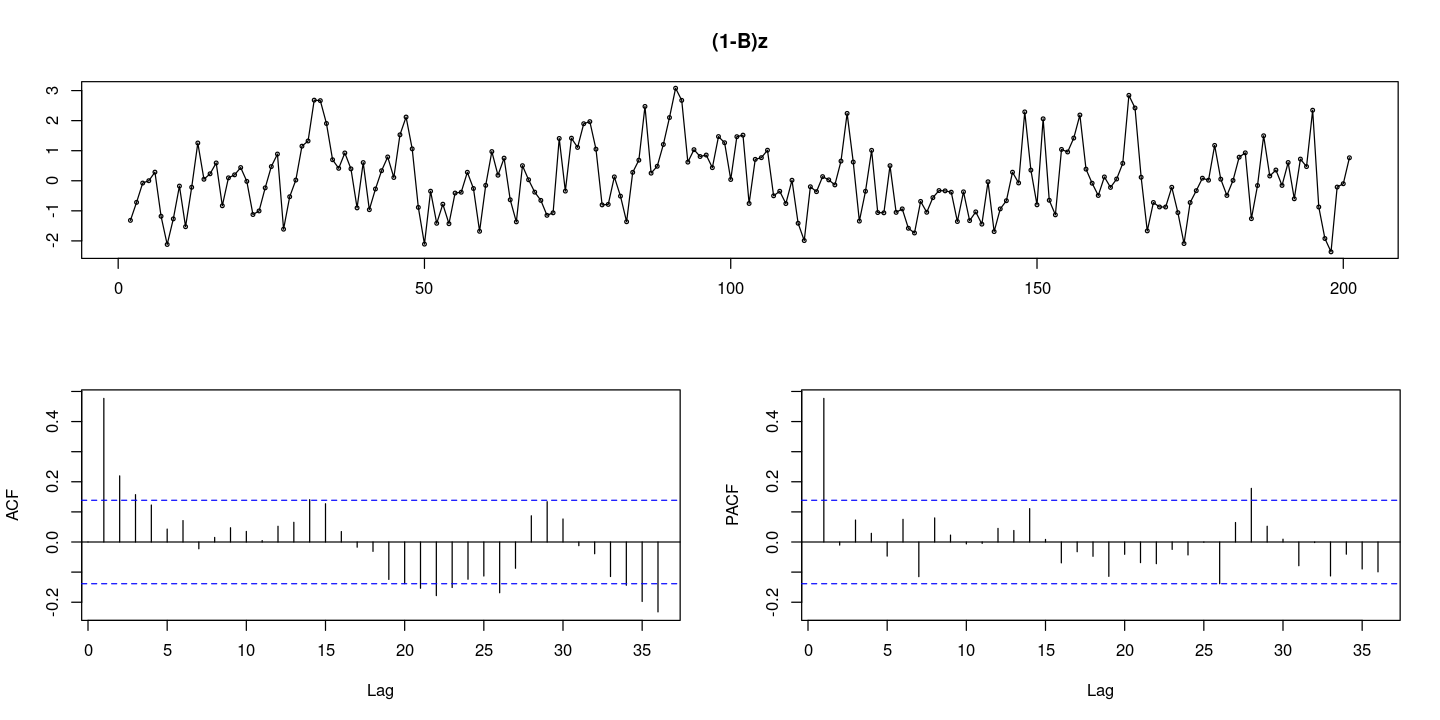

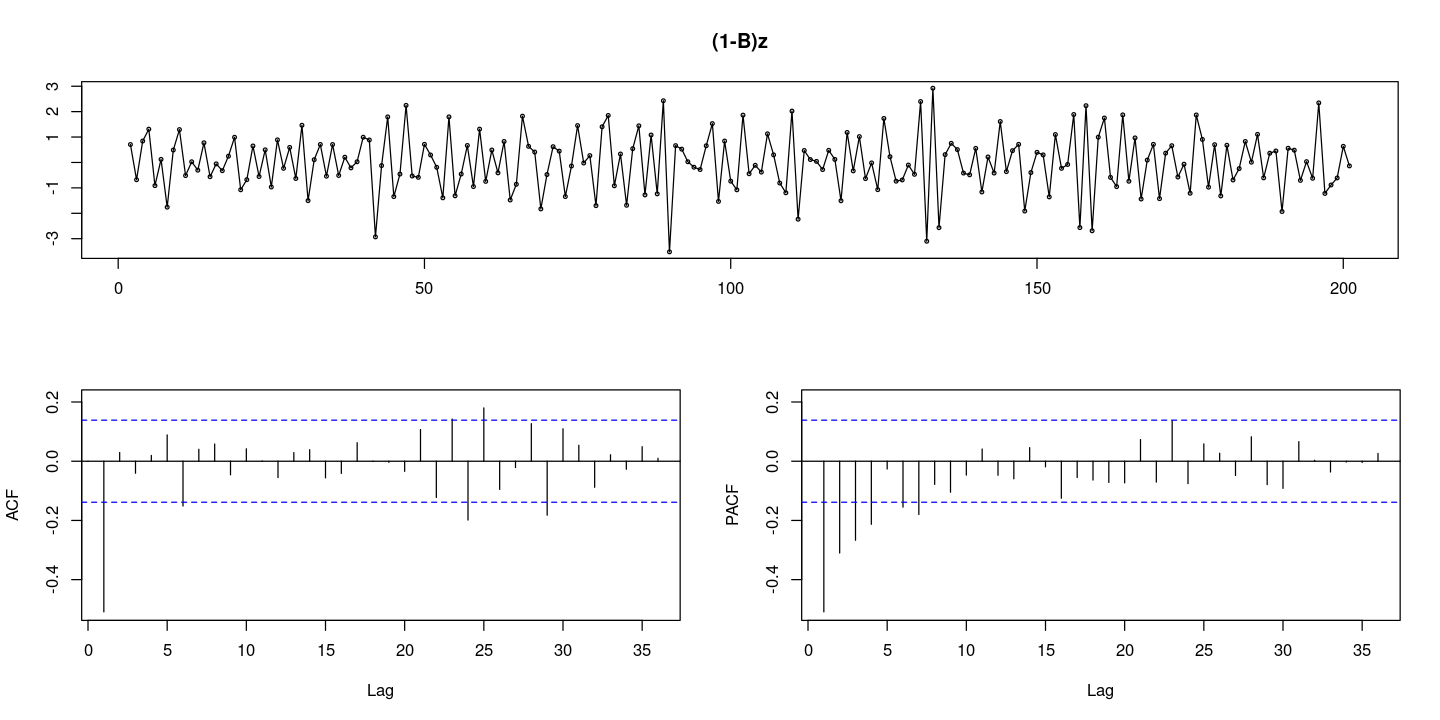

:: tsdisplay (diff (z), lag.max= 36 , main = "(1-B)z" )

<- 200 = arima.sim (n= n, list (order= c (0 ,0 ,1 ), ma= - 0.8 )) #MA(1) = arima.sim (n= n, list (order= c (0 ,1 ,1 ), ma= - 0.8 )) #ARIMA(0,1,1)

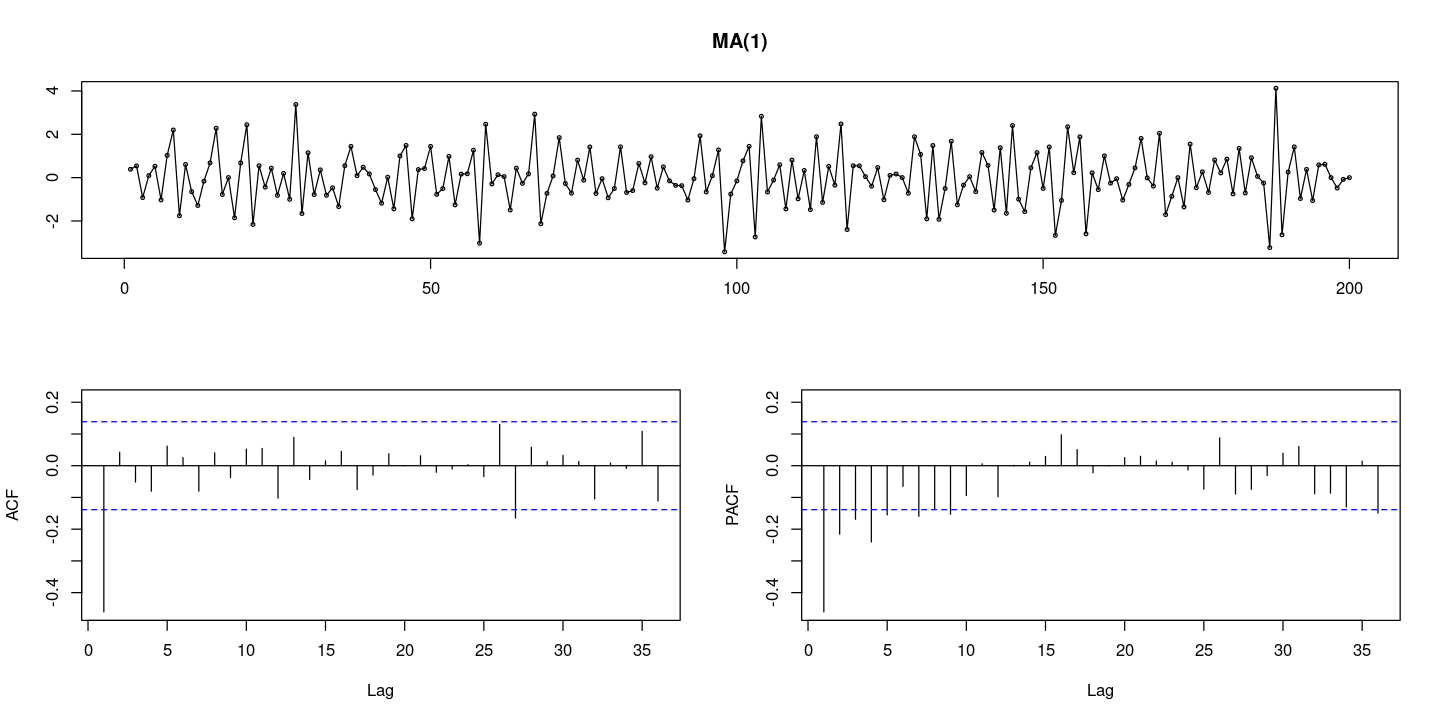

:: tsdisplay (x, lag.max= 36 , main = "MA(1)" )

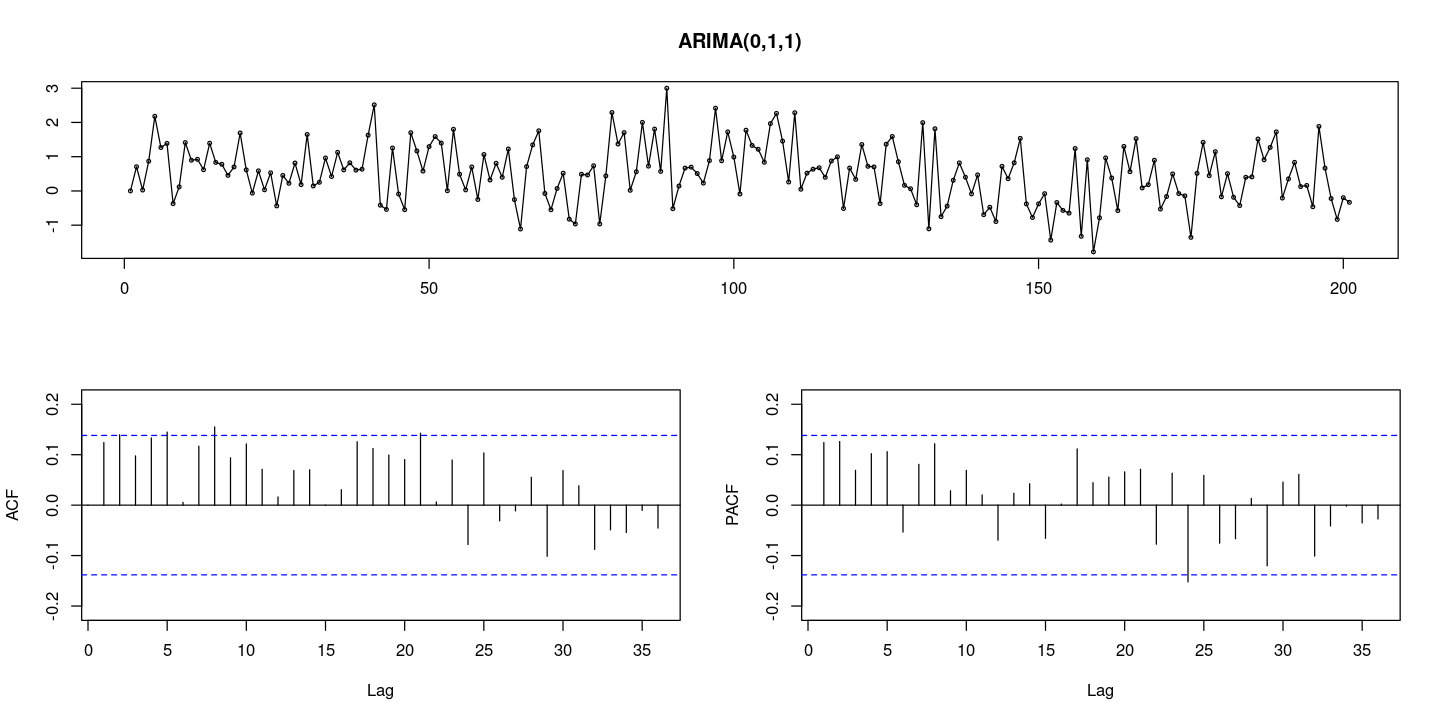

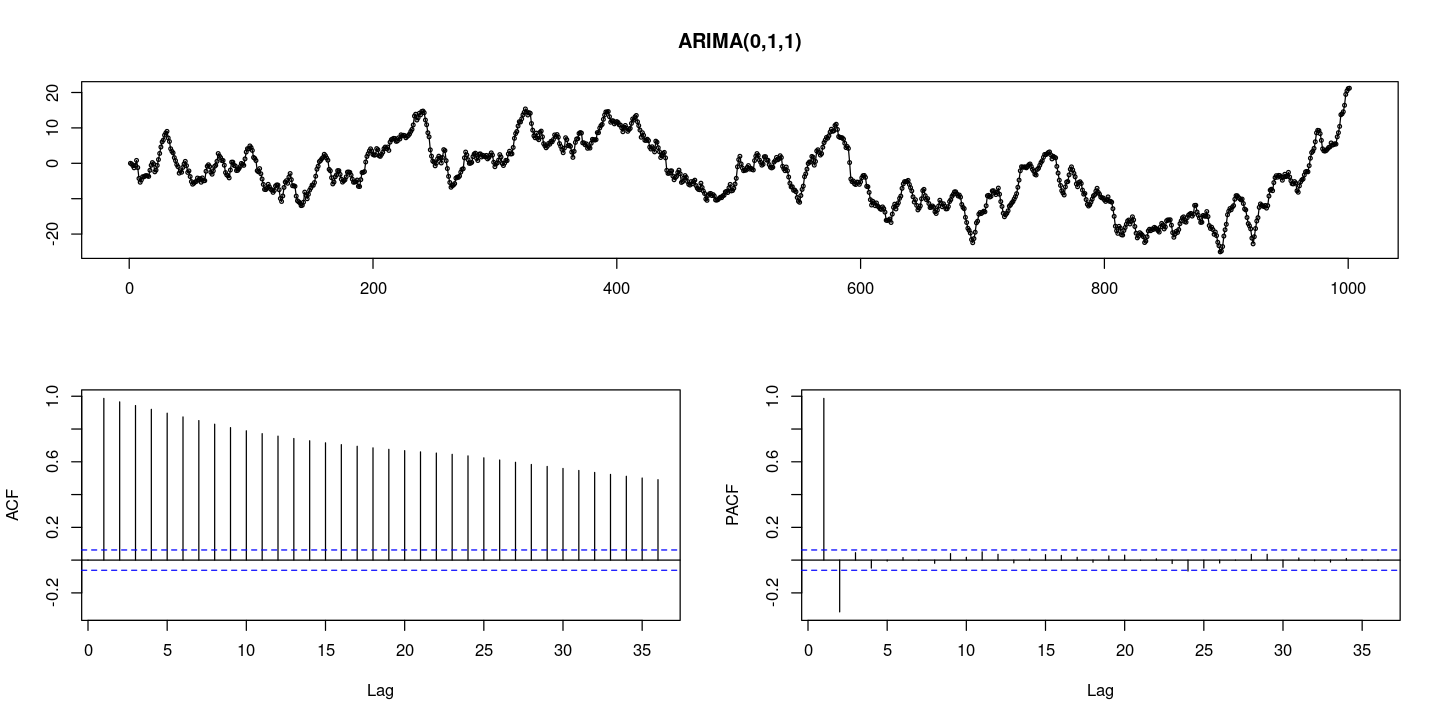

:: tsdisplay (z, lag.max= 36 , main = "ARIMA(0,1,1)" )

:: tsdisplay (diff (z), lag.max= 36 , main = "(1-B)z" )

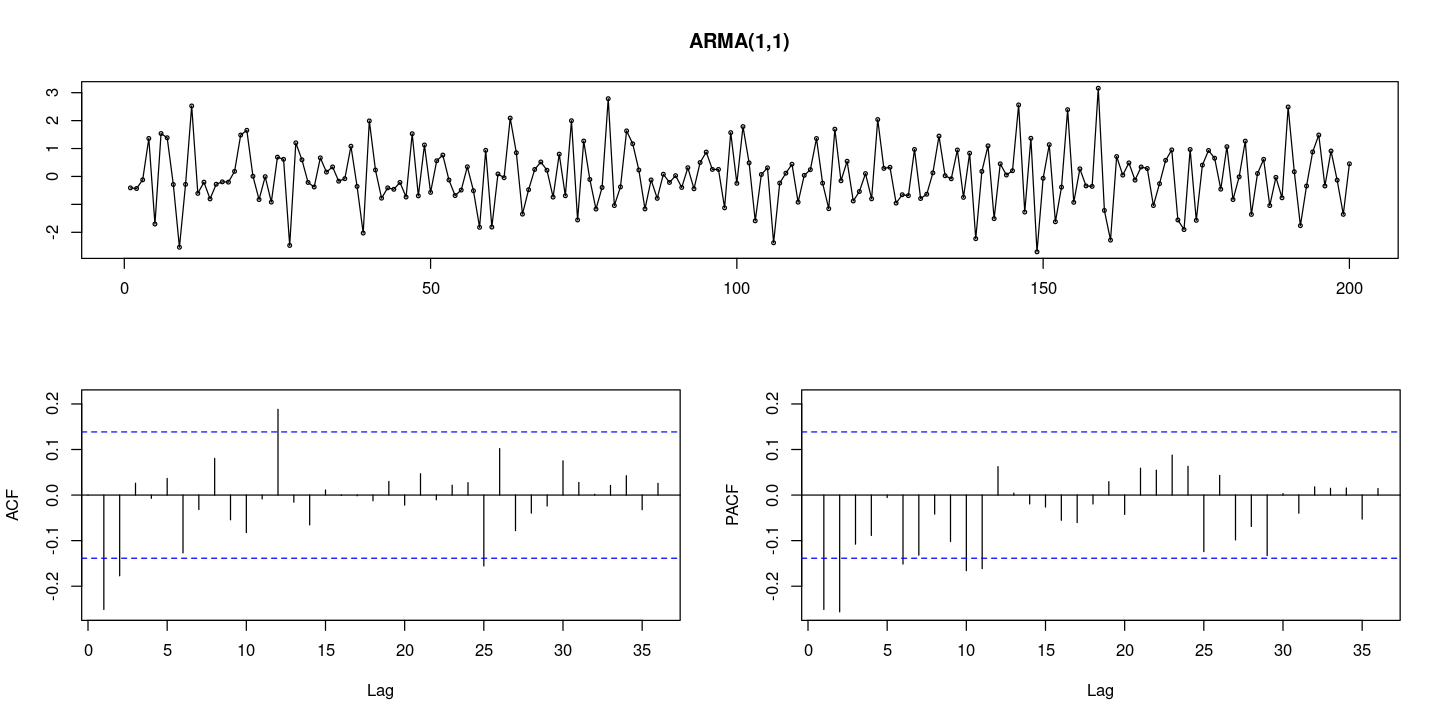

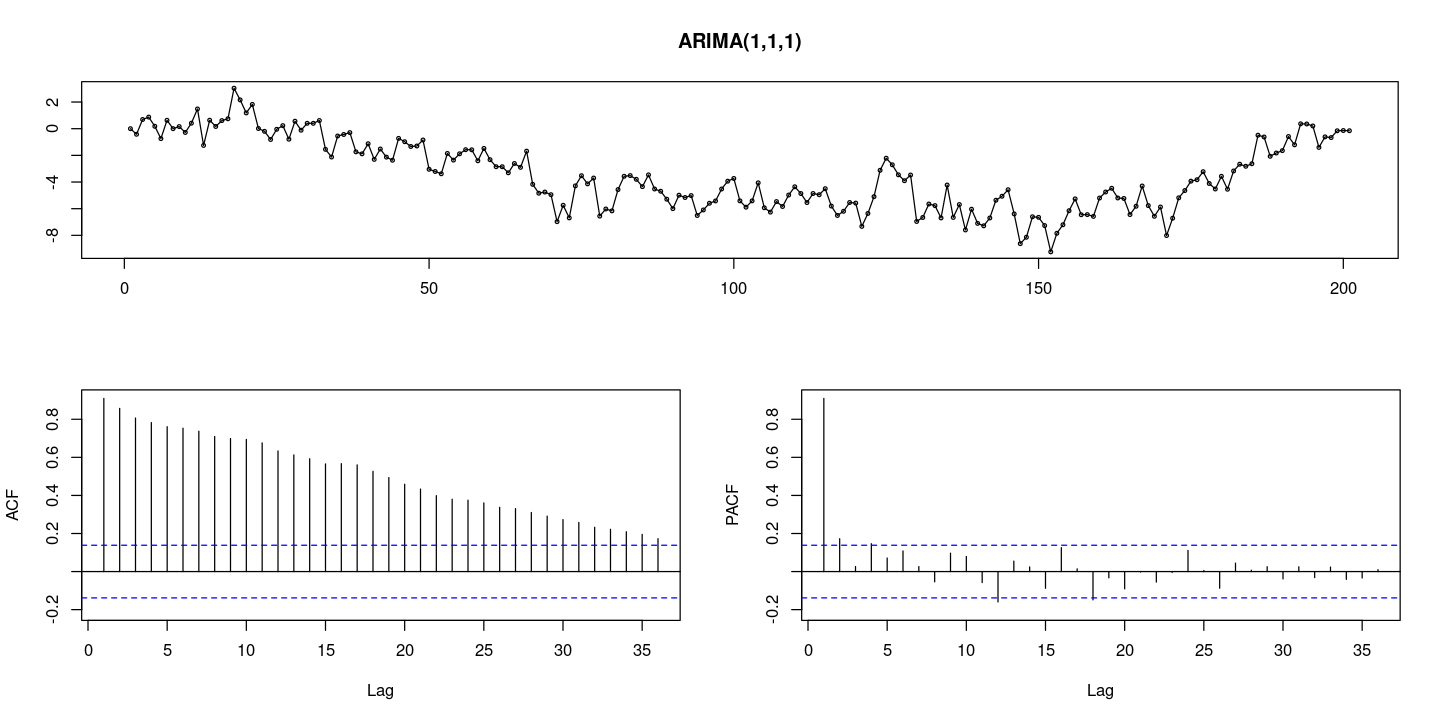

<- 200 = arima.sim (n= n, list (order= c (1 ,0 ,1 ), ar= 0.5 , ma= - 0.8 )) #ARMA(1,1) = arima.sim (n= n, list (order= c (1 ,1 ,1 ), ar= 0.5 , ma= - 0.8 )) #ARIMA(1,1,1)

:: tsdisplay (x, lag.max= 36 , main = "ARMA(1,1)" )

:: tsdisplay (z, lag.max= 36 , main = "ARIMA(1,1,1)" )

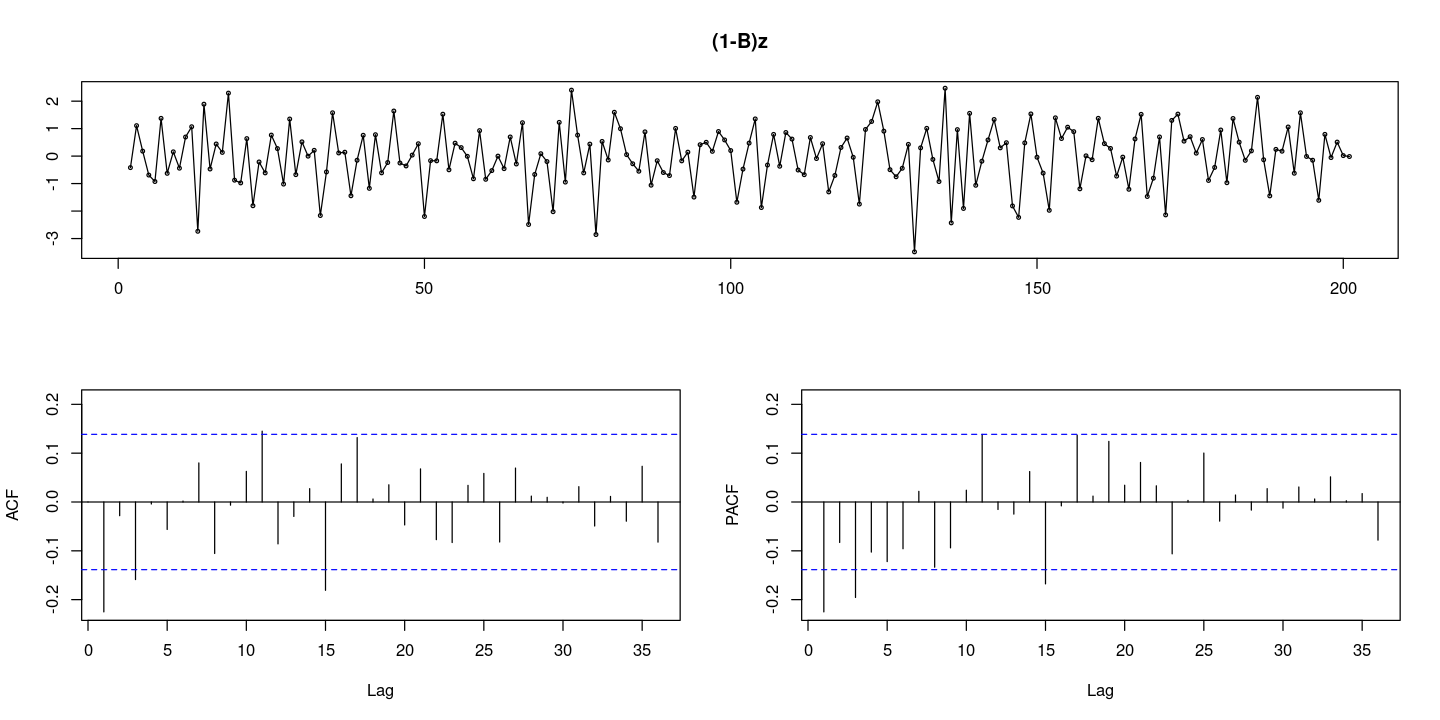

:: tsdisplay (diff (z), lag.max= 36 , main = "(1-B)z" )

과대차분

## ARIMA(0,1,1) = arima.sim (n= 1000 , list (order= c (0 ,1 ,1 ), ma= 0.5 ))

:: tsdisplay (z, lag.max= 36 , main = "ARIMA(0,1,1)" )

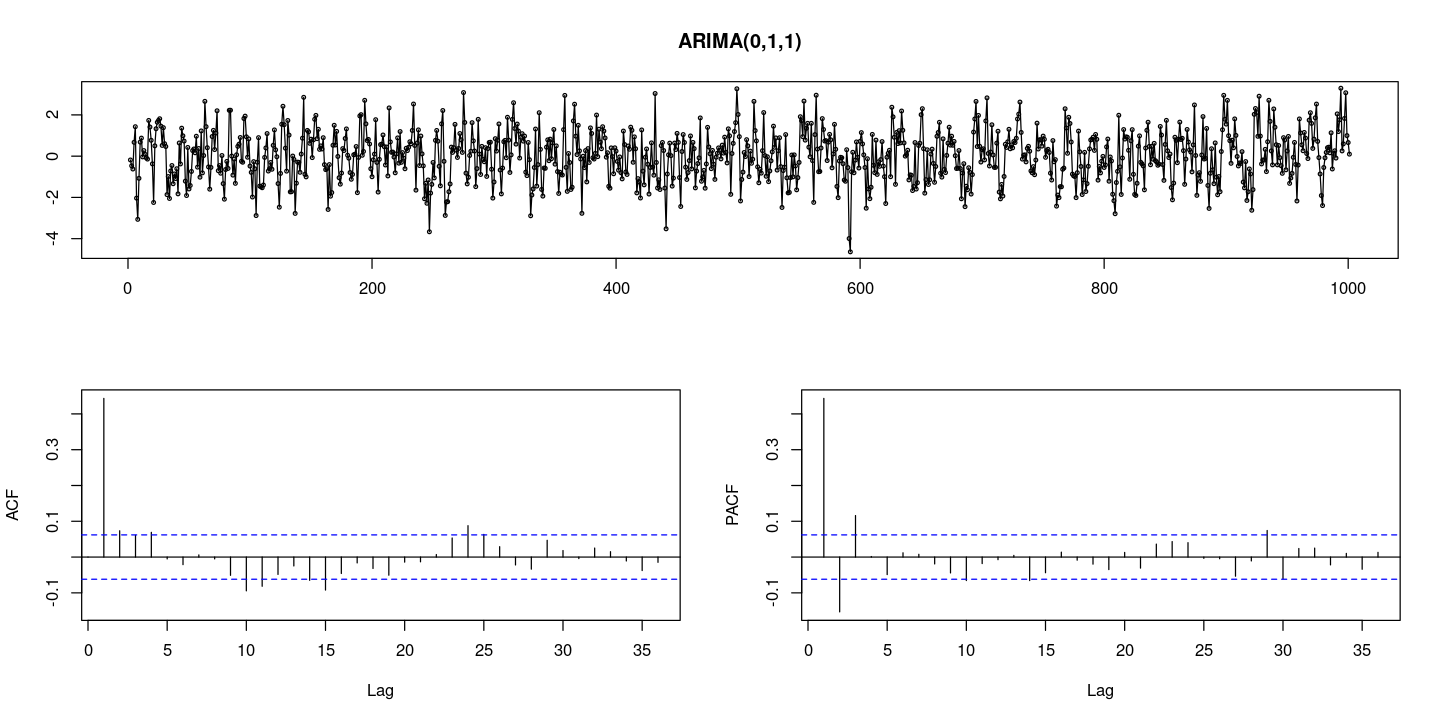

#한 번 차분 <- diff (z):: tsdisplay (d_z, lag.max= 36 , main = "ARIMA(0,1,1)" )

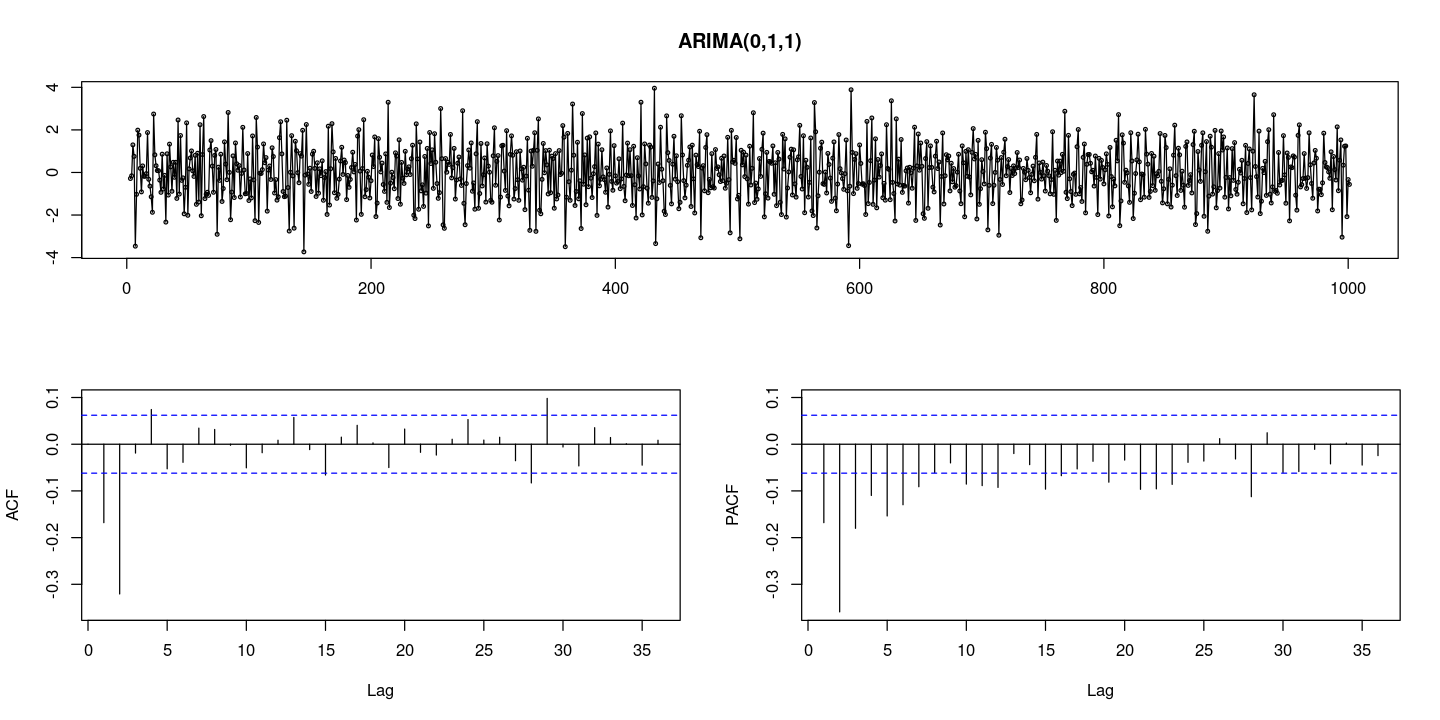

# 한 번 더 차분 <- diff (d_z):: tsdisplay (d2_z, lag.max= 36 , main = "ARIMA(0,1,1)" )

한 번 차분을 하면 정상시계열이 된다. 그리고 한 번 더 차분해도 마찬가지로 정상시계 열이다

sd (z)sd (diff (z))sd (diff (diff (z)))

8.72895467185367

1.18251197758341

1.2484612507557

차분을 두번 하고 나면 분산이 커진다. 이를 과대차분이라고 한다